About Econlinguistics

Econlinguistics combines the fields of economics and linguistics. Using techniques from machine learning, natural language processing and econometrics, this emerging area of research is concerned with the economic impact of spoken and written language.

Econlinguistics combines the fields of economics and linguistics. Using techniques from machine learning, natural language processing and econometrics, this emerging area of research is concerned with the economic impact of spoken and written language.

Economics is the study of the production, distribution and consumption of goods and services, which takes place in a complex system of verbal and written agreements. Econlinguistics aims at shedding light on the natural intersection of economics and linguistics. As such, econlinguistics is heavily concerned with the transmission of information between agents in an economic system.

Econlinguistics research group

The Econlinguistics Research Group (ERG) was established 2019 in order to foster interdisciplinary research with a focus on the economics of language. As such, the group consists of data scientists, financial economists and researchers from related fields. Please direct any inquires towards research@econlinguistics.org

Publications

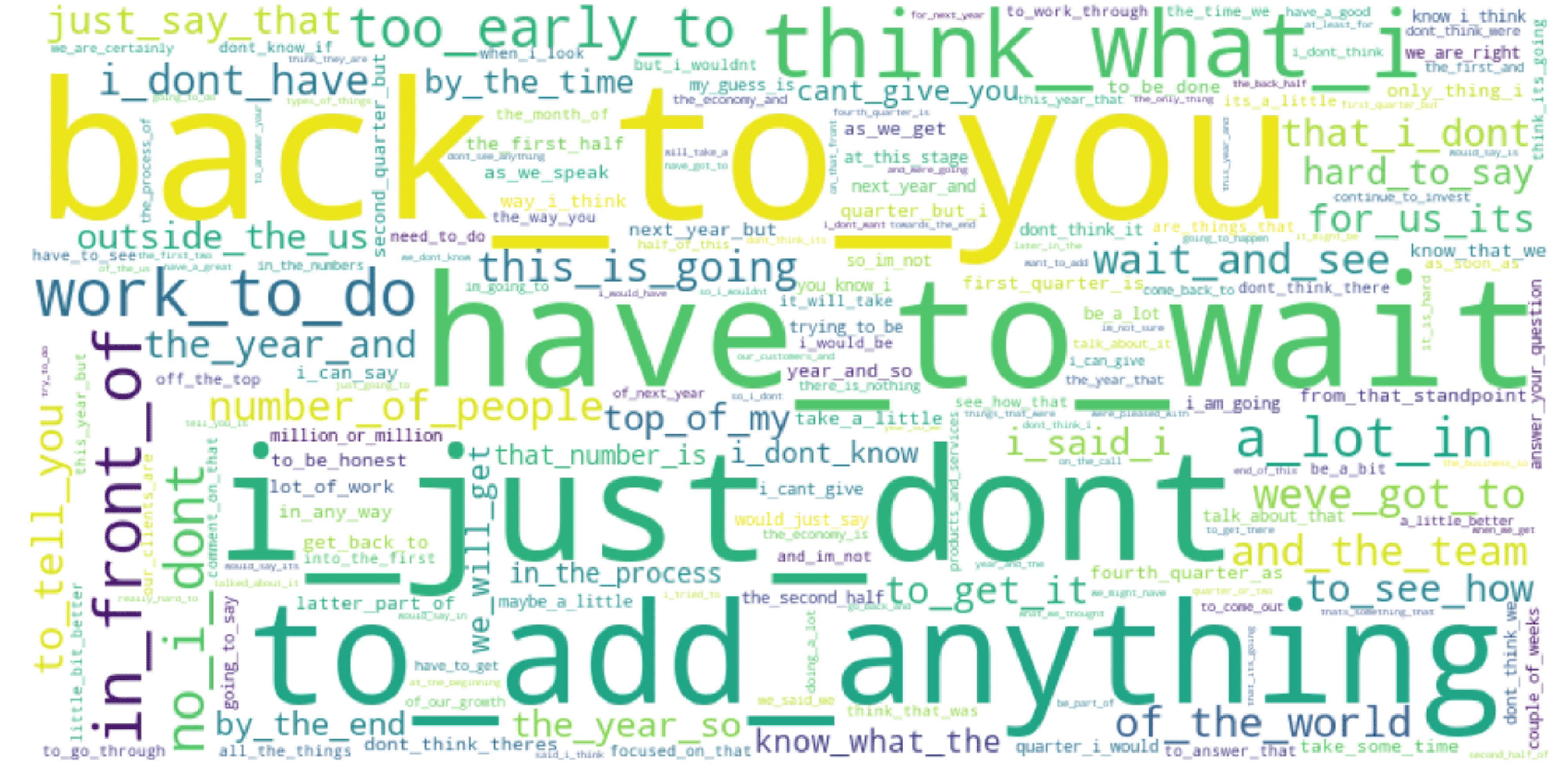

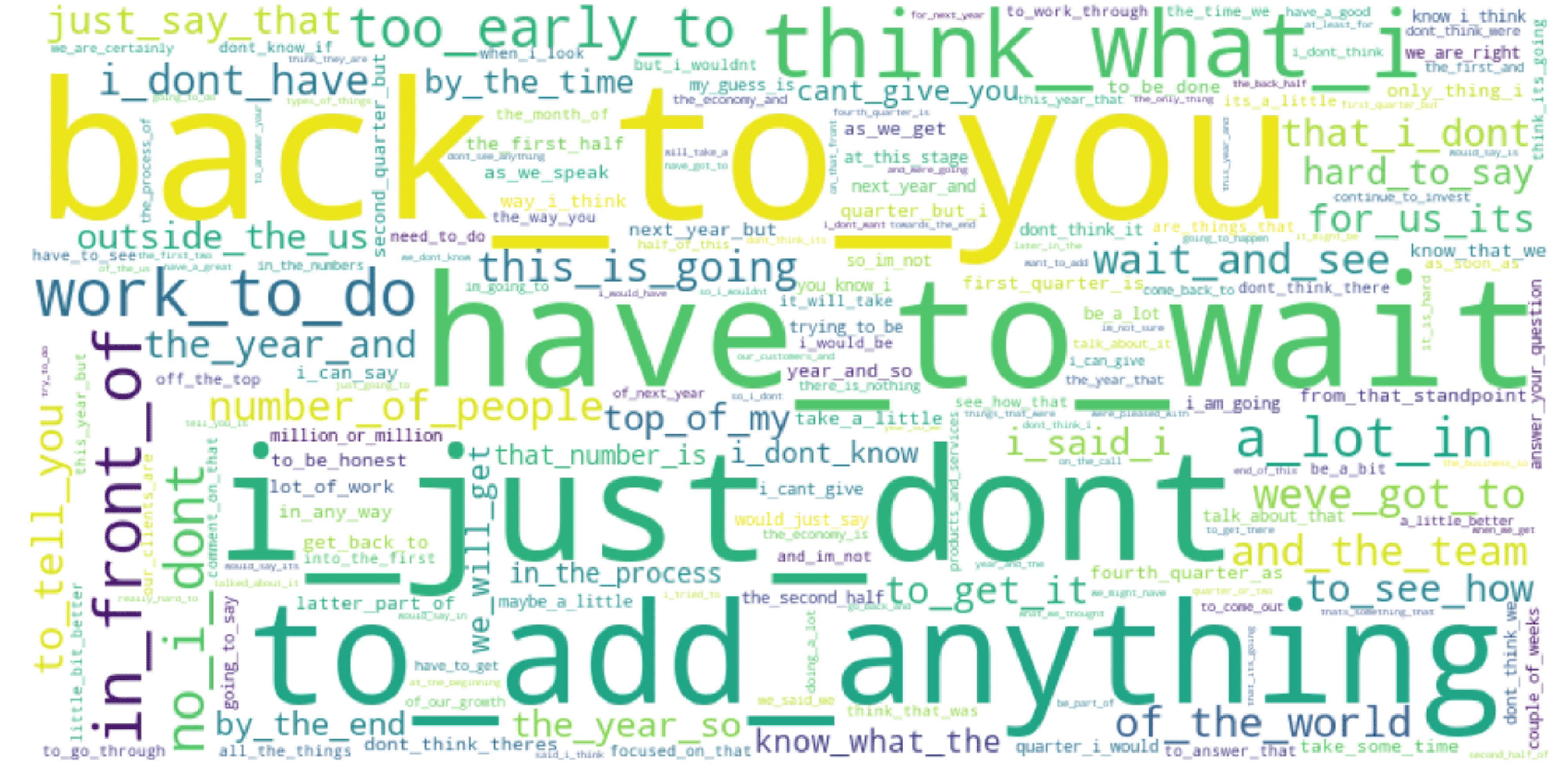

A. Barth, S. Mansouri and F. Woebbeking. "Let me get back to you" - A machine learning approach to measuring non-answers, 2020.

Revision requested from Management Science

Available at SSRN.

It is relatively easy for us humans to detect when a question we asked has not been answered – we aim to teach this skill to a computer. Using a supervised machine learning framework on a large training set of questions and answers, we identify 1,364 trigrams that signal non-answers in earnings call Q&A. We show that this glossary has economic relevance by applying it to contemporaneous stock market reactions after earnings calls. Our findings suggest that obstructing the flow of information leads to significantly lower cumulative abnormal stock returns and higher implied volatility. As both our method and glossary are free of financial context, we believe that the measure is applicable to other fields with a Q&A setup outside the contextual domain of financial earnings conference calls.

A. Barth, S. Mansouri, F. Woebbeking and S. Zörgiebel. How to Talk down Your Stock Performance, 2021.

Revision requested from Journal of Banking & Finance

Available at SSRN.

We process the natural language of verbal firm disclosures in order to study the use of context specific language or jargon and its impact on financial performance. We observe that, within the Q&A of earnings conference calls, managers use less jargon in responses to tougher questions, and after a quarter of bad economic success. Moreover, markets interpret the lack of precise information as a bad signal: we find lower cumulative abnormal returns and a higher implied volatility following earnings calls where managers use less jargon. These results support the argument that context specific language or jargon helps to efficiently and precisely transfer information.

Glossary

Through permanent links, working with the glossaries on econlinguistics.org is as easy as:

# Python:

import pandas as pd

dict = pd.read_table('https://econlinguistics.org/glossary.txt', sep=',')

# R:

dict <- read.table("https://econlinguistics.org/glossary.txt", sep=",", header=TRUE)

// STATA:

import delimited https://econlinguistics.org/glossary.txt, delimiters(",")

Alternatively, you can try it out using our

'Shinyapp' HERE

.

glossary.txt (permanent link): This is the core glossary, containing 1,027 tokens (3-grams) with positive factor loads, which should serve most applications. Most importantly, this glossary is not specific to the contextual domain of earnings calls.

Econlinguistics combines the fields of economics and linguistics. Using techniques from machine learning, natural language processing and econometrics, this emerging area of research is concerned with the economic impact of spoken and written language.

Econlinguistics combines the fields of economics and linguistics. Using techniques from machine learning, natural language processing and econometrics, this emerging area of research is concerned with the economic impact of spoken and written language.